[ad_1]

Evgenii Mitroshin/iStock via Getty Images

Due to concerns over inflation, the supply chain, rising interest rates, and a possible recession, many industries have been hit hard recently. But one bright spot in the market involves oil and gas. Between an initial shortage caused by a significant ramping up of the economy following the global COVID-19 pandemic and then by significant pressure put on the system because of the fallout associated with Russia entering into Ukraine, prices for these fossil fuels have gone through the roof. As a result, there are certain companies, namely oil and gas exploration in production firms, that are benefiting tremendously from elevated prices. It remains to be seen how long this will last, especially if issues in Europe continue. But for now, some of the businesses that are thriving might be worth looking into. One such firm that recently raised its guidance and that is trading at a rather cheap multiple on a forward basis is Obsidian Energy (NYSE:OBE).

A necessary note

Unless otherwise stated, all references to the dollar or ‘$’ should be meant to refer to the Canadian dollar as opposed to the US dollar.

Obsidian Energy – A small Canadian producer

Usually when I write about oil and gas exploration and production firms, I focus on those with a large US presence. However, one company that came across my radar that is worth looking into is Obsidian Energy. This Canadian firm has operations principally in the western portion of Canada. As of this writing, the company has 5,627 gross and 4,433 net wells. Focusing solely on the net wells, an impressive 4,417, or 99.6%, are located in Alberta. The company has an interest in a further 6 net wells in the Northwest Territories and an ownership interest in 9 net wells in parts of the United States.

There are three big regions within Alberta where the company has production. The first of these is referred to as the Cardium Development Area. This is located in West Central Alberta and extends over 300 kilometers from Calgary to Grand Prairie. The company is currently the largest landowner in this area with 455 net sections of developed and undeveloped land. Next, we have the Peace River Development Area. Unlike Cardium, which is a light oil play, Peace River is focused on heavy oil. It is located in Northwestern Alberta where the company has 473 net sections of developed and undeveloped land. While the company has plans for 19 gross wells for the 2022 fiscal year across Cardium, it’s planning just 10 wells this year and Peace River. And finally, we have the Viking Development Area. This is located in eastern Alberta along the Alberta/Saskatchewan border. The company has 144 net sections of developed and undeveloped land in that area. However, the company does not plan to develop any wells there this year due to the more favorable economics of the other aforementioned regions.

Like most oil and gas companies, Obsidian Energy is doing its best to create value for its investors while prices are high. This can be seen by looking at production levels spread across last year. Light and medium oil production in the first quarter of 2021 averaged 10,014 barrels per day. By the final quarter, this number had risen to 11,155. That represents an increase of at 11.4%. Heavy oil, conventional natural gas production, and NGL production also rose during this time frame. But now, management wants to accelerate things.

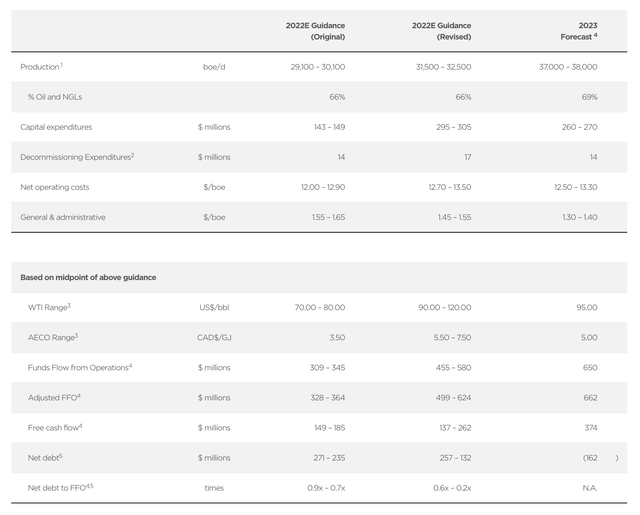

Obsidian Energy

On June 16th, the company announced plans to significantly increase capital expenditures for the 2022 fiscal year. At the midpoint, the current expectation is for spending of between $295 million and $305 million for the year. This compares to the prior expected range of between $143 million and $149 million. As a result of this, production for 2022 is now expected to be higher. Management currently sees this number coming in at 11.68 million boe (barrels of oil equivalent) for the year. That’s 8.1% above the 10.80 million management had in its prior guidance. Operating costs are expected to rise, even as general and administrative costs should drop. But between the lower general and administrative expenses and an increase in expected pricing for oil and gas, the company now anticipates generating operating cash flow, using midpoint expectations, of $499.5 million, while free cash flow should be $199.5 million.

It should be said that these expectations have a wide range. For instance, free cash flow is expected to be between $137 million and $262 million. That’s based on a wide range of energy prices, however, with WTI crude expected to be between US$90 and US$120 per barrel, while AECO pricing should be between $5.50 and $7.50 per GJ. By comparison, free cash flow, using midpoint figures, was previously forecasted to be between $149 million and $185 million.

Although it’s nice to see an upward revision for this year, the fact of the matter is that the current increase in spending will have a larger impact in 2023 than it will in 2022. At present, using midpoint figures, management anticipates total production of 13.69 million boe next year. That represents an increase of 17.2% compared to the expected figure for this year. Of course, the company will also spend a great deal of capital next year as well. The current tax dictation is for that to be between $260 million and $270 million. But the end result should be operating cash flow of around $639 million and $374 million.

Another important note

In the analysis portion of this article that follows, all references to the dollar or ‘$’ are to the US dollar unless otherwise specified.

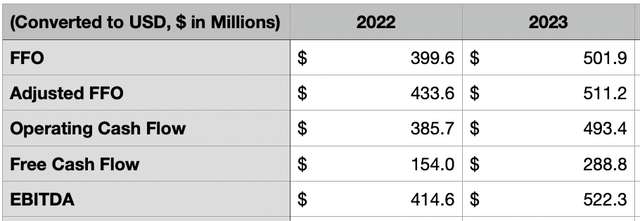

OBE stock looks cheap

Author – SEC EDGAR Data

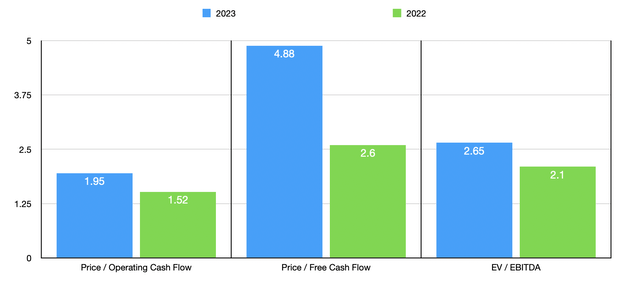

Although nobody knows what the future holds for oil and gas pricing, the fact of the matter is that the picture looks very appealing for Obsidian Energy if current expectations hold. This includes a scenario where WTI crude is just $95 per barrel. If this comes to fruition, shares of the company work to be rather cheap on a forward basis. Based on my own calculations, the company is currently trading at a forward price to operating cash flow multiple, using 2022 figures, of 1.95. This should drop to 1.52 based on 2023 estimates. Even the price to free cash flow multiple is low, coming in at 4.88 for this year and at just 2.60 for next year. In its own guidance, management forecasted a likely reduction in net debt. In my own analysis, I prefer to assume that management will use the cash by paying it out in dividends or buying back stock. Even if my more conservative approach ends up being correct, using 2022 figures, the company’s net leverage ratio is just 0.84.

Author

Takeaway

Based on the data provided, Obsidian Energy seems to be doing a fantastic job in the current environment. To be fair, it’s difficult to mess up when prices are drastically on your side. There’s obviously some risk that the energy markets will move into a state of oversupply. But for now, shares of the business look incredibly cheap even at prices that are lower than what they are today. Truly, this makes the company a compelling opportunity in my book, leading me to rate it a ‘strong buy’.

[ad_2]

Source link