[ad_1]

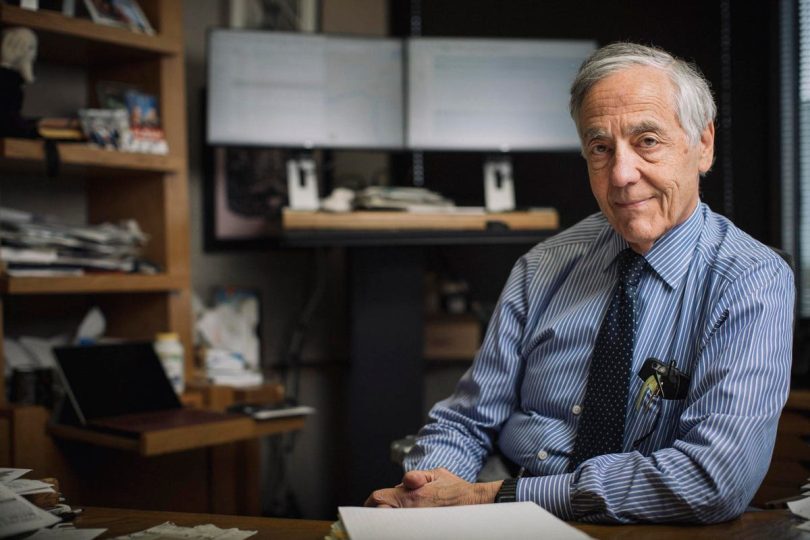

George Kaiser.

The Washington Post via Getty Images

The Oklahoma mogul spoke to Forbes about how he’s protecting his investments ahead of the “near certainty” of a recession.

With the S&P 500 entering a bear market last week, many of America’s billionaires are convinced that a recession is in the offing. George Kaiser, one of the wealthiest people in Oklahoma with an estimated $9.5 billion fortune, is one of them.

Kaiser, 79, told Forbes that a “recession seems a near certainty” and that he expects the economy to tip into a downturn in the first two quarters of 2023, with a prolonged dip in the stock market. The timing of the market bottoming out—the point at which the stock market hits a low and begins rising again—is still far off, according to Kaiser. “Historic analogies would suggest a 35% total drop from the peak, but that history is largely irrelevant since so many of the factors are unique,” he said.

Kaiser, who has appeared on the Forbes list of the 400 richest Americans for more than two decades, is no stranger to boom-and-bust cycles. His fortune is concentrated in oil and gas, with other holdings including a 55.8% stake in publicly traded Bank of Oklahoma (BOKF), a 20% stake in the NBA’s Oklahoma City Thunder, and several investments in both public and private companies through his private equity firm Argonaut. When oil prices collapsed in 2020, Kaiser’s oil businesses suffered and his estimated net worth fell to a fifteen-year low of $4.9 billion. A year later, his fortune had rebounded to $10 billion, thanks to a recovery in oil prices and private equity investments that benefited from the booming market of 2021.

Now that stock prices are falling and oil prices are rising further—the price of the U.S. oil benchmark WTI has surged by more than a third since the beginning of this year—Kaiser is managing his investments to weather a potential recession and come out on top.

“Recession seems a near certainty but it does not change our operating businesses’ strategies much since each marches to a different drummer,” he said. “Each investment business has its own unique adaptation.”

Kaiser’s oil and gas assets include Tulsa-based Kaiser-Francis Oil Company and Oklahoma City-based drilling contractor Cactus Drilling, both privately owned, as well as a 77.5% stake in liquid natural gas (LNG) shipping firm Excelerate Energy, which went public in April. Rising oil prices have provided a boost to independent oil firms like Kaiser’s: “We remain aggressive with drilling and production because this is a peak opportunity time,” he said.

As the Federal Reserve has raised interest rates to cool down rising inflation, that’s provided an upside for Bank of Oklahoma’s energy lending business. In its first quarter report, the bank disclosed that 15% of its total lending was made up of energy loans—$3.2 billion in total, including $2.4 billion to oil and gas producers, and a 6% increase since the beginning of the year. When interest rates rise, banks tend to make more money on the spread between the interest paid to customers and the interest earned from investing. “Energy lending—in which our competitors are pulling in their horns—provides an opportunity and the growing spreads from interest rate rises improve profitability,” Kaiser said.

Even when the stock market was still running hot, growing recession fears meant Kaiser had been expecting a downturn and investing accordingly. “Our primary new reaction to this [economic] environment has been S&P short hedges for some time (premature), which we are slowly unlayering with hope that we can pick the time fairly accurately to jump in long at the time of market capitulation,” he explained. What that means: He’s been betting that the S&P 500 index will fall. So far this year, the S&P 500 index has dropped by 20%.

It’s still uncertain how deep or long-lasting a recession would be, with Kaiser citing several factors including supply chain issues, the war in Ukraine and soaring inflation. And while average U.S. wages have risen since 2021, those gains risk being eaten up by higher prices for goods and services. Kaiser also expects it will be difficult to attract people to industries in need of more workers, such as hospitality, restaurants, nursing, teaching and trucking. “We are blessed to live in interesting times,” he said.

Asked when he thinks the stock market might rebound, Kaiser—whose fortune is roughly flat since January, a better performance than dozens of other billionaires and most other investors—ventured a guess that the market could bottom out around March or April next year. “Personal income will drive it, once we get all of the government subsidies back down to recurring rates here and in the rest of the world,” he said.

Still, Kaiser thinks that guessing the exact timing of the market’s rebound is a fool’s errand: “Like pornography, you know it when you see it.”

[ad_2]

Source link