[ad_1]

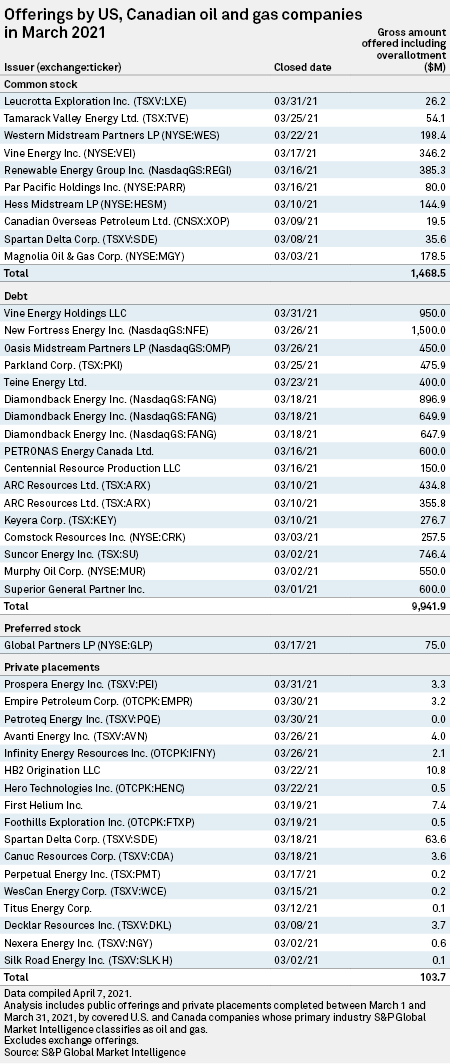

U.S. oil and gas companies covered by S&P Global Market Intelligence raised $11.59 billion in March, an increase from the $7.76 billion of capital recorded in February. Debt offerings made up the bulk of the total with $9.94 billion, while common stock deals, preferred stock offerings and private placements contributed a combined amount of $1.65 billion.

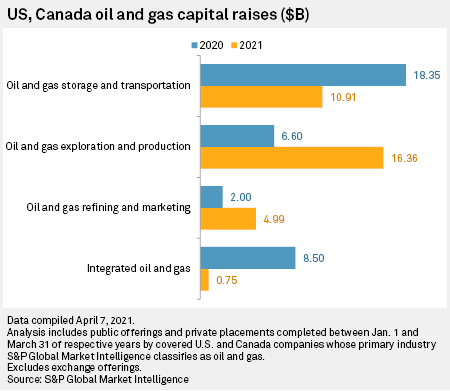

Year to date, oil and gas exploration and production companies recorded the highest year-over-year boost after having raised $16.36 billion. Oil and gas refining and marketing companies have pulled in $4.99 billion, up from the $2.00 billion collected in the same year-ago period. As of March, oil and gas storage and transportation companies and integrated oil and gas companies have brought in $10.91 billion and $750 million, respectively, both of which are lower than the capital raised in the same period a year earlier.

Common stock

* Leucrotta Exploration Inc. on March 31 sold 45,205,600 units for $26.2 million. The company will use the deal’s proceeds for product development, working capital and other general corporate purposes.

* Tamarack Valley Energy Ltd. on March 25 sold approximately $54.1 million of 30,303,000 common shares. The proceeds will be used for acquisitions, working capital and general corporate purposes.

* Western Midstream Partners LP on March 22 sold 11,500,000 common shares for $198.4 million. The offering was upsized to include 10,000,000 common shares, and the selling unitholder granted underwriters a 30-day option to buy an additional 1,500,000 common shares.

* Vine Energy Inc. on March 17 sold 24,725,000 class A common shares for $346.2 million. Vine Energy will use the proceeds to repay debt and for general corporate purposes and working capital.

* Renewable Energy Group Inc. on March 16 sold 5,750,000 common shares for proceeds of $385.3 million, including overallotment. The company said it will use the offering’s proceeds for working capital and general corporate purposes.

* Par Pacific Holdings Inc. on March 16 sold $80.0 million of 5,000,000 common shares. The company will use the proceeds for debt repayment, general corporate purposes and working capital.

* Hess Midstream LP on March 10 sold 6,900,000 class A common shares for proceeds of $144.9 million. The partnership said it will not get any proceeds from the offering.

* Canadian Overseas Petroleum Ltd. on March 9 sold 4,375,000,000 common shares for approximately $19.5 million. Canadian Overseas Petroleum plans to use the deal’s proceeds for working capital and general corporate purposes.

* Spartan Delta Corp. on March 8 sold 11,250,000 common shares for about $35.6 million. Proceeds from the deal will be used for acquisitions and debt repayment, among others.

* Magnolia Oil & Gas Corp. on March 3 sold $178.5 million of 17,000,000 class A common shares. Magnolia said it has also agreed to buy from the selling stockholders 5,000,000 of the corporation’s class B common shares.

Debt

* Vine Energy Holdings LLC on March 31 issued 6.75% senior notes due April 15, 2029, for $950.0 million. The offering’s proceeds will be used for debt repayment, working capital and other general corporate purposes.

* New Fortress Energy Inc. on March 26 offered $1.50 billion of 6.5% senior secured notes due 2026. New Fortress said it will use the proceeds for acquisitions, working capital and general corporate purposes.

* Oasis Midstream Partners LP on March 26 issued $450.0 million of 8% senior unsecured notes due April 1, 2029. The proceeds will be used for a distribution to a subsidiary and to repay debt.

* Parkland Corp. on March 25 sold $475.9 million of 4.375% senior notes due March 26, 2029. The corporation will use the offering’s proceeds to repay debt.

* Teine Energy Ltd. on March 23 offered 6.875% senior notes due April 15, 2029, for $400.0 million. The deal’s proceeds will be used for debt repayment, general corporate purposes and working capital.

* Diamondback Energy Inc. on March 18 issued 3.125% senior unsecured notes due 2031 for $896.9 million, 0.9% senior unsecured notes due 2023 for $649.9 million and 4.4% senior unsecured notes due 2051 for $647.9 million. Proceeds from the offerings will be used for debt repayment, general corporate purposes and working capital.

* PETRONAS Energy Canada Ltd. on March 16 issued $600.0 million of 2.112% senior notes due March 23, 2028. The company will use the deal’s proceeds to repay debt and for working capital and general corporate purposes.

* Centennial Resource Production LLC on March 16 sold 3.25% senior notes due April 1, 2028, for $150.0 million. The company estimates proceeds of approximately $144.5 million, which will be used for debt repayment, general corporate purposes and working capital.

* ARC Resources Ltd. on March 10 offered 3.465% senior unsubordinated unsecured notes due 2031 for $434.8 million and 2.354% senior unsubordinated unsecured notes due 2026 for $355.8 million. ARC Resources will use the proceeds for acquisitions, working capital and general corporate purposes.

* Keyera Corp. on March 10 offered fixed-to-fixed rate subordinated notes due March 10, 2081, for proceeds of $276.7 million. The 5.95% interest rate of the notes is payable every March 10 and Sept. 10, starting on Sept. 10 this year. The corporation will use the proceeds to repay the debt under its revolving credit facility and for its ongoing capital program and other general corporate purposes.

* Comstock Resources Inc. on March 3 issued 6.75% senior unsecured notes due March 1, 2029, for proceeds of $257.5 million, which will be used for debt repayment, working capital and general corporate purposes.

* Suncor Energy Inc. on March 2 sold $746.4 million of 3.75% senior notes due March 4, 2051. Suncor will use the proceeds for debt repayment, investment in securities, working capital and general corporate purposes.

* Murphy Oil Corp. on March 2 offered 6.375% senior notes due 2028 for $550.0 million. The corporation will use the offering’s proceeds to repay debt and for working capital and other general corporate purposes.

* Superior General Partner Inc. on March 1 issued senior unsecured notes due 2029 for $600.0 million. The company plans to use the proceeds to repay debt.

Preferred stock

* Global Partners LP on March 17 offered series B cumulative preferred units for $75.0 million. The units will bear a fixed dividend rate payable quarterly. Net proceeds from the offering will be used to pay down debt under the partnership’s credit agreement.

Private placements

* Prospera Energy Inc. on March 31 received about $3.3 million in gross proceeds during a nonbrokered placement of 3,350,000 units and convertible debenture units. The company intends to use the transaction’s proceeds for general operating purposes, such as debt payment and continuing capital programs.

* Empire Petroleum Corp. on March 30 received approximately $3.2 million in a transaction, under which the corporation issued 8,993,857 shares along with warrants to 38 investors. The warrants are exercisable until Dec. 31, 2022.

* Petroteq Energy Inc. on March 30 completed a private placement of 581,026 common shares for gross proceeds of $22,660. A single investor participated in the deal.

* Avanti Energy Inc. on March 26 closed a nonbrokered private placement of up to 5,000,000 common shares for gross proceeds of $4.0 million, which will be used for general working capital purposes and project review and acquisition. The deal included participation from 67 investors.

* Infinity Energy Resources Inc. on March 26 closed a private placement of 22,776 series A convertible preferred shares for gross proceeds of $2.1 million. The company will use the deal’s proceeds to purchase the production and mineral rights to and a leasehold stake in certain oil and gas properties in the Central Kansas uplift geological formation, among others.

* HB2 Origination LLC on March 22 received $10.8 million in funding. The deal included participation from 35 investors.

* Hero Technologies Inc. on March 22 received $520,000 in funding. Four investors participated in the transaction.

* First Helium Inc. on March 19 completed a best-efforts brokered private placement of 26,285,714 shares for gross proceeds of about $7.4 million. First Helium will use the proceeds for working capital and general corporate purposes.

* Foothills Exploration Inc. on March 19 closed a private placement of a 12% convertible promissory note for proceeds of $481,500. The deal included participation from returning investor Labrys Fund LP.

* Spartan Delta on March 18 issued 10,976,626 common shares on a flow-through basis and a separate 6,250,000 common shares for gross proceeds of $63.6 million. Existing shareholders participated in the transaction.

* Canuc Resources Corp. on March 18 completed a private placement of 18,000,000 units for gross proceeds of approximately $3.6 million. The corporation intends to use the proceeds for drilling on the San Javier Silver-Gold project.

* Perpetual Energy Inc. on March 17 closed a private placement of 1,000,000 shares for gross proceeds of $184,000, which the company will use for working capital purposes.

* WesCan Energy Corp. on March 15 closed a nonbrokered private placement of up to 4,000,000 common shares for gross proceeds of approximately $160,000. The corporation will use the transaction’s proceeds for the further development and workovers of selected wells in Provost, Alberta, and for general working capital purposes, among others.

* Titus Energy Corp. on March 12 issued 105,134,880 common shares for gross proceeds of $84,000. Selected insiders of the company participated in the deal for a total of 13,140,000 common shares.

* Decklar Resources Inc. on March 8 completed a private placement for gross proceeds of about $3.7 million, which will be used by the company to reenter the Oza-1 well at the Oza oil field in Nigeria and for general corporate purposes.

* Nexera Energy Inc. on March 2 closed a private placement of 13,333,333 units for gross proceeds of up to $634,000. Nexera plans to use the proceeds for mineral lease acquisitions, renewals and drilling of the Patriot wells, service equipment purchases and working capital purposes.

* Silk Road Energy Inc. on March 2 completed a private placement of 6,580,000 units for gross proceeds of up to $131,000. The company intends to use the proceeds for legal fees, audit fees, late filing and participation fees and accounting fees, among others.

[ad_2]

Source link