[ad_1]

In a bid to send a strong message on climate action, the Group of Seven (G-7) countries has agreed to end direct public financing of fossil fuels by the end of the year and work toward ending subsidies by 2025.

In a meeting last month in Berlin, the G-7 nations made a formal commitment to the goal of decarbonizing electricity sectors by 2035. Part of this includes phasing out coal-fired power generation, though no formal deadline was announced for this commitment.

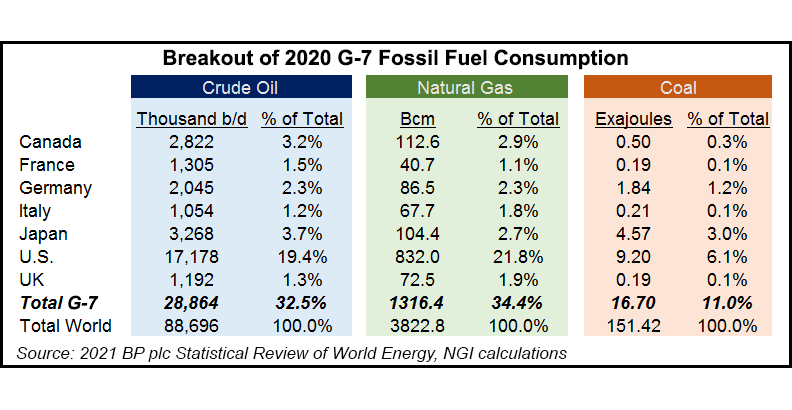

The G-7 countries include Canada, France, Germany, Italy, Japan, the UK and the United States – spanning several of the world’s largest economies.

Noting the importance of national security and geostrategic interests, the G-7 members said there would be some exceptions in limited circumstances to fossil fuel financing that are consistent with a 1.5 C warming limit and the goals of the Paris Agreement.

“This is enormous progress, which is more important than ever in times like these and in view of Russia’s terrible war of aggression against Ukraine,” said German Vice Chancellor Robert Habeck, who also serves as Federal Minister for Economic Affairs and Climate Action. “Climate action, the coal phase-out and the expansion of renewable energies are matters of national, European and international energy security. We have to take resolute action on them together.”

In agreeing to end fossil fuel subsidies by 2025, the G-7 members outlined a goal to report on this commitment in 2023 and consider options for developing joint public inventories of fossil fuel subsidies. The organization said fossil fuel subsidies are inconsistent with the goals of the Paris Agreement.

Notably, however, the group called on oil and gas producing countries to “act in a responsible manner and to respond to tightening international markets” in light of Russia’s aggressions. It pointed out that there is a necessity to consider measures to stop the increase in energy prices driven by current market conditions, without compromising key climate policy mechanisms to drive the energy transition.

To that end, the G-7 countries stressed the role increased deliveries of liquefied natural gas (LNG) can play in order to mitigate potential supply disruptions of pipeline gas, especially to the European markets. European storage facilities have injected at a feverish pace since the spring, reaching more than 45% of capacity this week, according to Gas Infrastructure Europe.

The White House in March pledged to expedite approvals for LNG projects and coordinate additional LNG supplies to Europe to end the continent’s dependence on Russian fossil fuels by 2027.

Also in March, the European Commission unveiled its REPowerEU plan, which aims to diversify natural gas supplies, accelerate the use of renewable gas and replace natural gas in heating and power generation to help slash the continent’s reliance on Russian supplies. It also calls for a series of measures to respond to rising energy prices, including price regulation, state aid and tax measures.

As part of last week’s meeting, the G-7 countries also launched the G7 Hydrogen Action Pact, in which the group would cooperate on market ramp-up, development, regulation and support of hydrogen value chains. Several development plans have been announced among the G-7 members for the production of hydrogen.

Williams, one of the largest U.S. midstream companies, has its sights on hydrogen development in Wyoming at upstream acreage acquired this year through a joint venture with Crowheart Energy. The Wyoming Energy Authority (WEA) earlier in July approved a grant for Williams “to evaluate water access and compatibility as well as asset integrity in support of green hydrogen production and transport” in the area.

Rockpoint Gas Storage, Certarus Ltd., Plug Power Inc. and FortisBC are collaborating on a hydrogen pilot project at an industry site in southeastern Alberta, Canada. The test is set to launch this fall.

[ad_2]

Source link