[ad_1]

Das underscored the RBI’s favor towards innovation within the financial technology sector, highlighting the introduction of Sandbox for testing new tools. He used a simple analogy, likening the situation to owning and driving a Ferrari while still adhering to traffic rules to prevent accidents. He said that one may own and drive a Ferrari but still one has to obey the traffic rules to avoid accidents.

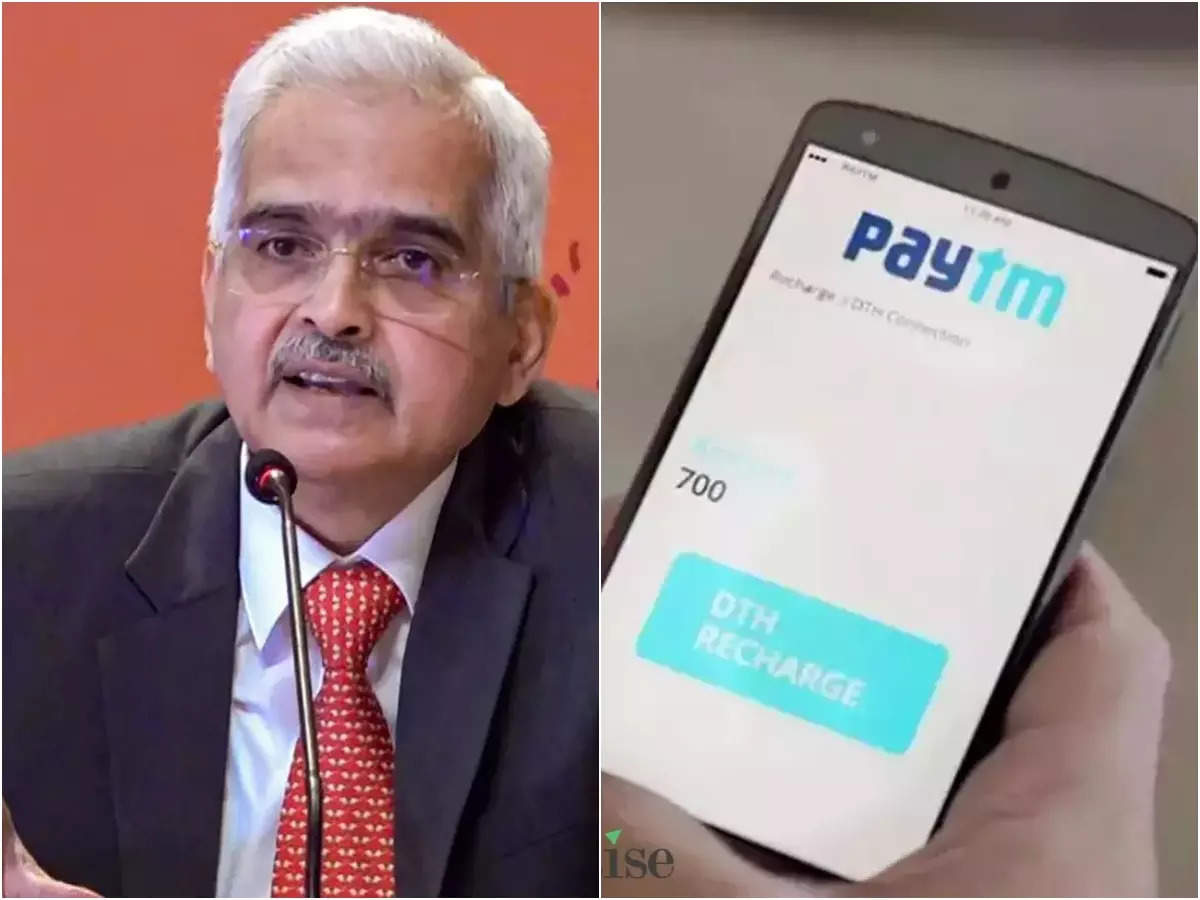

Regarding the deadline for linking wallets attached to PPBL with other banks, Governor Das stated that March 15 remains the fixed deadline, with no plans for further extension. He expressed confidence in the sufficiency of the given time frame, noting that 80-85 per cent of Paytm wallets are already linked to other banks, with the remaining 15 per cent advised to make the transition promptly.

When questioned about the timeline for NPCI’s decision on the Paytm payment app license, Das clarified that it is subject to internal due diligence. “So far, as RBI is concerned, we have informed them that we have no objection if NPCI considers the Paytm payment app to continue because our action was against the Paytm Payment Bank. The app is with the NPCI… NPCI will take a call… I think they should be taking a call shortly,” he stated.

RBI Governor Shaktikanta Das reassured that 80-85% of Paytm wallet users won’t be affected by regulatory measures, with the remaining advised to link their accounts to other banks. The Reserve Bank of India prohibited Paytm Payments Bank (PPBL) from certain transactions since January 31. Das affirmed the March 15 deadline for wallet linkage, dismissing further extensions, emphasizing ample time and support for compliance. He clarified that RBI’s actions targeted PPBL, not the entire Fintech sector, advocating innovation and introducing Sandbox for experimentation. In an interview with ET Now, Das reiterated RBI’s full support for Fintech’s growth.

[ad_2]

Source link