[ad_1]

Overview

The results summarise the model output on the different layers; the trade network layer, the transport network layer, and the port supply-chain layer. These three layers are conceptualised in Supplementary Fig. 1. The trade network layer results discuss the output of the global modal split model (i.e. the distribution of trade flows across transport modes) that quantifies the variations in a country’s dependency on maritime trade as a fraction of total trade on a commodity level. The transport network layer results outline several output of the OxMarTrans model. The OxMarTrans model simulates the route choice of millions of maritime freight flows between 3400 regions across 207 countries on the hinterland and maritime transport network. The output includes the aggregate global freight flows on the transport network and through the two main canals (Suez and Panama), the dependency of countries on maritime infrastructure in foreign jurisdictions through land-based connections and transhipments, the port-level trade flows, and the trade flow distribution across all ports. To quantify the domestic and global economic dependencies on trade flows through ports (i.e. the port supply-chain layer), we use the EORA MRIO tables32 that we extend to the port-level to link the commodities that flow through ports the global supply-chains they serve. Two metrics are constructed to capture these dependencies; (1) the port-level output coefficient (PLOC) and (2) the port-level import coefficient (PLIC). The base year considered in this analysis is 2015, which is the latest available year in the EORA MRIO database (at the time of writing). Throughout this study, we adopt a 11 sector industry classification in line with the EORA MRIO to evaluate differences in criticality between sectors (Supplementary Table 1).

Share of maritime transport in global trade

Within the trade network layer, the amount of maritime trade between countries is determined by the absolute value of trade across all modes between country pairs and the share of this being maritime. Our transport modal split model estimates the share of maritime trade for around 8 million bilateral trade flows globally on a commodity level (HS6). It should be noted that in this study the mode of transport is defined as the dominant transport mode (longest distance) in the supplier-consumer connection, which means that landlocked countries can still rely on maritime transport (see Methods).

We estimate that 9.4 billion tonnes of trade, equivalent to around 7.6 USD trillion in value terms, was maritime in 2015. The share of maritime trade in global trade is around 75% in terms of weight and 50% in terms of value. This number corresponds well with the estimated 9.96 billion tonnes of trade being discharged in ports in 2015 as reported by UNCTAD40. However, large differences exist between sectors. For instance, while 75.7% (86.0%) of Mining and Quarrying (sector 3) products are transported by means of maritime transport in value (weight) terms, most manufacturing sectors (sector 4 to 11) transport only 40% – 57% (53% – 60%) of their trade in value (weight) terms using maritime transport.

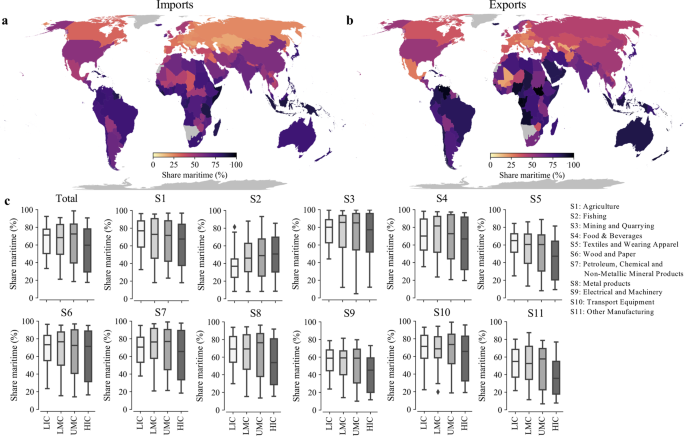

Figure 1 shows the percentage of maritime transport in total imports (Fig. 1a) and total exports (Fig. 1b) per country, while Supplementary Figs. 2 and 3 display the same results per economic sector considered. The dominance or absence of maritime transport for trade is mainly determined by the geographical location of trading partners (e.g. distance, island state), the presence of alternative (fast and cheaper) modes, the value to weight ratio of the commodities, and the standard of living of the importing country (e.g. quality of logistics services)41.

Country’s percentage of maritime imports (a) and exports (b) based on the 2015 trade network. c Boxplots of the percentage maritime imports per economic sector with countries grouped by income level (based on the World Bank income classification). LIC: Low income countries, LMC: Lower middle income countries, UMC: Upper middle income countries, HIC: High income countries.

As can be seen from Fig.1, Caribbean islands, countries in Oceania and some countries in Africa (e.g. Somalia, Nigeria, Gabon) rely disproportionally on maritime transport for both imports and exports (Fig. 1a, b). European countries, in particular landlocked countries (e.g. Romania, Hungary, Switzerland), have a much lower share of maritime transport, mainly due to the large trade flows between European countries that use road, rail and inland waterway transport to move goods over relatively short distances42,43. Middle-Eastern (Saudi Arabia, United Arab Emirates) and South American (e.g. Brazil, Colombia) countries rely more on maritime transport for their exports compared to their imports. These countries mainly export raw materials (e.g. oil, coal, grain) which is predominantly shipped by maritime vessels, but import a more diversified mix of goods that are transported by multiple modes. Small Island Developing States (SIDS) rely disproportionally on maritime transport, with 86.5% of imports and 79.8% of exports being maritime, thus almost twice as much as non-SIDS countries. SIDS are often served by a only a few maritime transport routes and experience high transportation costs44, making reliable maritime transport services critical for the well-functioning of SIDS’ economies.

Figure 1c shows the share of maritime transport in total and sector-specific imports grouped by the income level of countries (using the 2021 World Bank classification). Low income countries import on average 1.5 times more by means of maritime transport compared to high-income countries (68% versus 45%). The difference is largest for the manufacturing sectors (sector 8 to 11), having maritime shares 1.5 – 1.8 times higher than high income countries. This difference can be explained by the fact that low income countries often trade low value bulk goods, for which maritime transport is the only viable option, and relatively few high valued goods that are more often transported by aeroplane45. Even within the same continent, such as in Africa, maritime transport is often the only feasible mode of transport for certain goods as the road infrastructure lacks the reliability and capacity for efficient trucking, and border crossings can be time consuming46,47. Therefore, the integration of low income countries into complex manufacturing supply-chains, which critically depend on just-in-time logistics services48, could be hindered by their overreliance on maritime transport, which is considerably slower than air transport49,50.

Global maritime transport flow allocation

The maritime transport network, consisting of ports and maritime routes transporting goods using different vessel types (e.g. tankers, containers), connects the locations of production to their demand markets. The OxMarTrans model predicts which ports and maritime routes, including locations of transhipments, are being used to transport the maritime trade flows between each country pair and per economic sector (see Methods). The underlying hinterland and maritime consists of 1378 ports, with the port connections and maritime network capacities incorporated in the model based on a dataset of observed ship activities from Automatic Identification System (AIS) data9. The OxMarTrans model therefore helps identify the spatial connectivity of ports; the maritime subnetwork that is used to transport goods from and to a specific port (we show the spatial connectivity for nine ports in Supplementary Fig. 4).

Globally, to meet maritime trade demand, we estimate that 90.5 trillion tonnes-km of freight is transported across sea and an additional 33.4 trillion tonnes-km over land to connect hinterlands to ports. The maritime freight predicted by the model consistent with the 84 trillion tonnes-km estimated by UNCTAD40. 43% of the total maritime tonnes-km is attributed to the Mining and Quarrying sector (sector 3) alone, while the manufacturing of Electrical and Machinery products (sector 9), Transport Equipment (sector 10) and Other Manufacturing goods (sector 11) together account for only 2.7% of total tonnes-km. Supplementary Fig. 5 shows the total throughput (sum of import, export and transhipment) per port and estimated flows on the maritime transport network, while Supplementary Fig. 6 shows a similar result per sector.

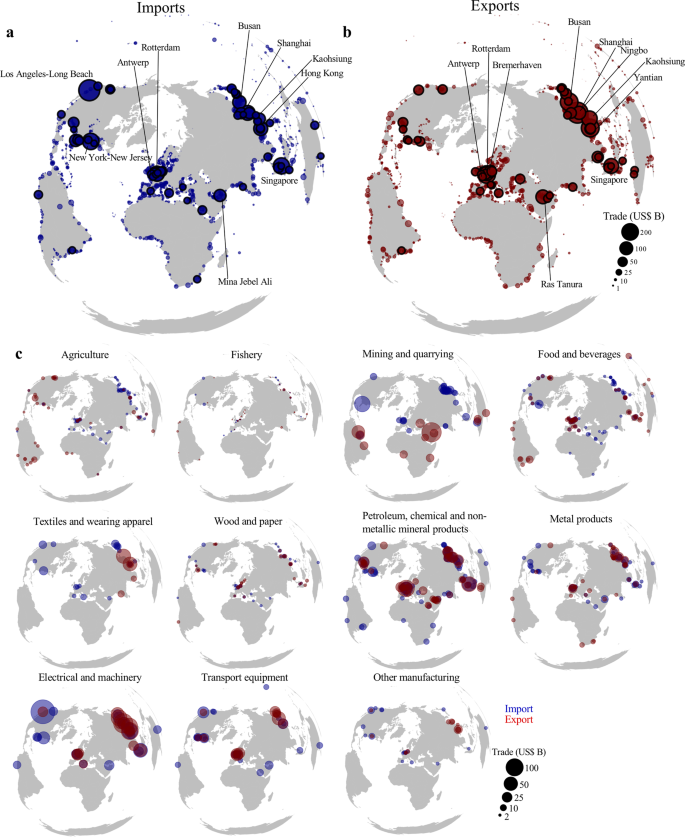

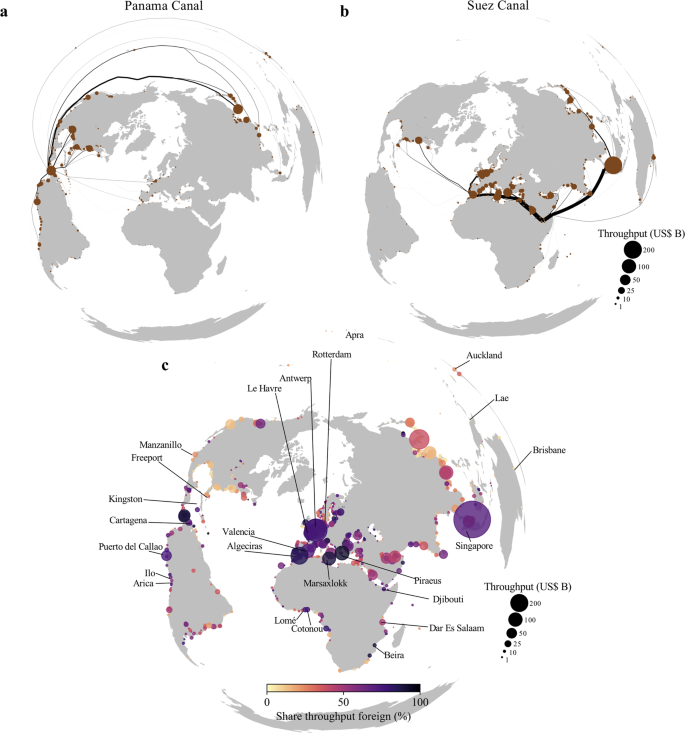

Many countries depend on the transport of goods passing the Suez or Panama canal. In total, our model predicts that around 1.1 USD trillion (13.9% of maritime trade) and 0.49 USD trillion (6.2% of maritime trade) pass the Suez and Panama canal, respectively, in 2015 in line with official statistics (see Supplementary Note 3). For the Panama canal, ports in the Gulf of Mexico, the west coast of South America, and parts of East Asia rely directly on goods being shipped through the canal (Fig. 2a). The Suez canal is important for trade going from and to the Asia and Europe. On the east of the canal, the ports of Singapore, Jeddah, Colombo, Mina Jebel Ali are most dependent on the Suez canal, while on the west of the Suez canal the ports of Piraeus, Rotterdam, Marsaxlokk and Algeciras rely most on it (Fig. 2b).

a The port-level throughput (import, exports and transhipment) that comes from or goes to ports by passing the Panama canal. b Same as (a) but for the Suez canal. c The share and absolute value of port-level throughput that is linked to a foreign economy, either because of transhipment or a land-based connection. Some regionally important ports in terms of foreign dependencies are annotated.

Cross-border maritime infrastructure dependencies

Both landlocked and maritime economies rely on maritime infrastructure in other countries because they either use ports in neighbouring countries to import or export goods, or they use transhipment services to ship goods from origin to destination. For instance, around 28% of the world’s container throughput in 2012 involved transhipment, where containers unloaded from a deepsea vessel are being transhipped to another deepsea vessel or a smaller vessel (i.e. feeder vessels) to serve otherwise unconnected port pairs51.

Using the OxMarTrans, we estimate that approximately 16.4% of global port throughput (in value terms) is transhipped, while 19.4% of port throughput are imports to or exports from foreign countries connected via the hinterland transport network. Figure 2c shows the fraction of port throughput being foreign per port. In absolute terms, large transhipment hubs (Singapore, Algeciras, Valencia and Marsaxlokk) have a high share of foreign throughput. Additionally, ports in the Le Havre-Hamburg range (Le Havre, Antwerp, Rotterdam, Bremen) handle the largest amount of foreign import and export value, as they compete for trade going to, and coming from, the Central European hinterland52.

Regionally, some ports play key roles in serving landlocked countries or island states (see highlighted port in Fig. 2c). In Africa, for instance, the port of Djibouti handles almost all of Ethiopia’s maritime trade, the ports of Dar Es Salaam (Tanzania) and Beira (Mozambique) are essential for landlocked countries in Sub-Saharan Africa, while the port of Lomé (Togo) and Cotonou (Benin) are key for Western-African landlocked countries. In South America, the ports of Arica (Chile) and Ilo (Peru) handle the majority of maritime trade of Bolivia, while Puerto del Callao (Peru) is an important transhipment hubs for South America. In Oceania, several ports (e.g. Brisbane, Auckland, Apra, Lae) serve as important transhipment hubs for Pacific island economies, with a similar observation for key regional transhipment hubs in the Caribbean region (see Fig. 2c).

Distribution of trade flows per port

Several factors determine the total maritime trade flows going through ports (e.g. maritime connectivity, logistics services, presence of hinterlands). Figure 3a, b shows the distribution of imports (Fig. 3a) and exports (Fig. 3b) across all trade flows, with the top 10 largest ports annotated. We also show the global core ports, defined as those ports responsible for importing or exporting 50% of global trade (black edge colour). Core importing ports are located in North-America (Los Angeles-Long Beach, New York-New Jersey), Western Europe (Rotterdam), the Middle-East (Mina Jebel Ali) and Asia (Singapore, Shanghai) that serve the populated hinterlands (so-called gateway ports39) or industrial and logistics hubs. Among the core exporting ports are specialised ports that are critical for the exports of agricultural products (Vancouver, New Orleans, Santos), petrochemicals (Houston, Singapore, Rotterdam), iron ore (Port Hedland and Dampier), electrical and machinery manufacturing (Shanghai, Busan, Kaohsiung), car manufacturing (Ulsan, Nagoya, Bremerhaven), and oil and gas (Ras Tanura, King Fahad Industrial Port).

The aggregated imports (a) and exports (b) per port. The critical ports are highlighted with the top 10 ports annotated. c The location of the critical importing (blue) and exporting (red) ports per sector.

Trade is highly concentrated in a relatively small number of core ports. The trade unevenness expresses the number of ports that handle 10%, 50% and 90% of trade. Only 4 (3) ports are responsible for 10%, 56 (48) ports are responsible for 50%, while 378 (366) ports are accounting for 90% of global maritime imports (exports) (Supplementary Table 2). This underlines that from a global perspective, the maritime transport network consists of a small number of core ports and a large number of secondary (i.e. periphery) ports.

The aggregate results do hide the importance of certain ports on a sector level. Figure 3c shows the geographical location of the core importing and exporting ports per sector, showing a clear geographical clustering of trade flows that are either connected to important demand markets53, or closely located to large sector-specific industry clusters53. Agriculture trade (sector 1) has clear origin ports in the United States, Brazil and Argentina, serving ports in Europe and across Asia. The import and export hotspots of Mining and Quarrying (sector 3) and Food and Beverages (sector 4) products are more spread across the globe, reflecting the export specialisation of different regions (e.g. oil in Middle-East, iron ore and coal in Australia, food products in Indonesia and Malaysia). The Wood and Paper manufacturing (sector 6) sector has large exporting ports in Scandinavia, the United States and China, that export timber products to ports in the United Kingdom, Japan and the Middle-East. Metal products (sector 8) are exported through Chinese, South African and Chilean ports and supplied to the Middle-East, South-East Asia and the United States. The remaining manufacturing sectors (sector 5, 9-11) all have large exports in ports in Western-Europe, East-Asia and the United States, with goods imported in ports in the Middle-East, Australia and parts of South America.

The trade unevenness differs considerably per sector (see Supplementary Table 2). The largest unevenness is found for the exports of Textiles and Wearing Apparel (sector 5), manufacturing of Transport Equipment (sector 10) and Other Manufacturing (sector 11) while the lowest level of trade unevenness is found for the imports of Agricultural products (sector 1), Food and Beverages (sector 4), and Petroleum, Chemical and Non-Metallic Mineral products.

These sectoral heterogeneities do not only reflect the differences in the clustering of industries, but also economies of scale present in the transport of some goods54,55. For example, while for some highly concentrated sectors the vast majority of goods will be transported between a subset of core ports, other less concentrated sectors will use a more decentralised transport network. These sectoral differences reinforce the results found in previous studies that analysed the characteristics of networks of different types of maritime vessels (which are indicative of the sector) and found similarly critical differences between these vessel networks11,35,39.

Port-level output coefficient

Every port is connected to one or multiple supply-chains in the domestic and foreign economies they serve, either through direct (e.g. through firms directly sending or receiving goods from a port) or indirect (e.g. through firms depending on other firms that send or receive goods from a port) economic connections. More specifically, the products that are imported through a port are either directly consumed in an economy or are used in production processes to produce goods for domestic consumption or export. Additionally, goods exported through a port are being used in production processes, or directly consumed, elsewhere. We call this the port supply chain network. To understand the criticality of the trade facilitation function of ports for domestic and global supply-chains, we developed a metric, called the port-level output coefficient (PLOC), that captures the total industry output and consumption directly or indirectly dependent on the trade flows through a port, either in absolute terms (PLOCA) or relative to the amount of trade going through a port (PLOCR). This is done by removing the trade flows going through a port from the extended MRIO table and quantifying the output changes to the domestic and global economy (see Methods).

In relative terms (PLOCR), every USD of trade going through a port influences on average (5th−95th percentiles) 4.34 (3.84 – 5.03) USD of value in the global economy (Supplementary Fig. 7). Large relative values are found for ports in East-Asia (e.g. China, South-Korea, Taiwan), which are strongly integrated in global supply-chains, but also for some of the raw materials exporting ports in Australia (e.g. Port Hedland and Dampier) and Africa (e.g. Port of Saldanha), which are important for supply-chains downstream (e.g. firms using intermediate products that are produced using raw materials).

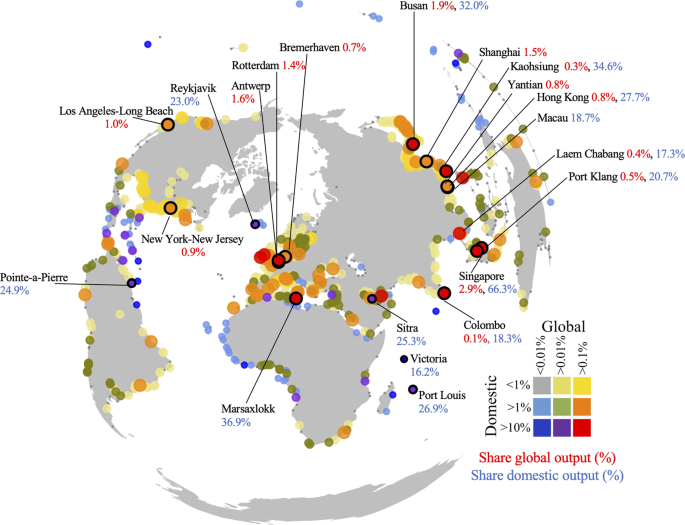

In absolute terms (PLOCA), some ports are important for the domestic economy, while others are more important for the global economy. In some cases, ports are critical for both, as outlined in Fig. 4a, which shows the top 10 most critical ports for the domestic economy and the global economy. The top 5 most critical ports for the global economy (Singapore, Shanghai, Busan, Rotterdam, Antwerp) all handle goods that directly or indirectly contribute to >1.4% of global industry output. In total, 94 ports are considered macro critical for global supply-chains, indicating that more than 0.1% of global industry output depends on these ports. 40 ports are considered domestically critical, with over 10% of industry output dependent on trade going through a single port. Examples of some ports that are critical for the domestic economy but negligible on a global scale (dark blue or purple markers Fig. 4a) are the ports of Port Louis (Mauritius, 26.9% of domestic output), Pointe-a-Pierre (Trinidad and Tobago, 24.9% of domestic output), Reykjavik (Iceland, 23.0% domestic output) and Sitra (Bahrain, 25.3% of domestic output). The ports of Kaohsiung (Taiwan), Hong Kong (Hong Kong), Laem Chabang (Thailand), and Port Klang (Malaysia) (red markers Fig. 4a) are found to be essential for both the domestic and global economy. A similar figure can be produced for the final consumption needs of countries, with globally and domestically critical ports shown in Supplementary Fig. 8. Although an overall similar spatial footprint, some ports are more important for meeting final consumption, especially for some small island economies where single ports import over 35% of the final consumption requirement. Hence, the tendency to focus on the absolute size of trade going through a port to classify its importance ignores how some smaller ports are still critical for domestic economies.

The importance of trade flows going through ports in terms of its contribution to the domestic output as a percentage of total domestic output and global output as a percentage of total global output. The ten ports most critical ports in terms of domestic and global output are highlighted together with the associated percentage value (domestic in blue, global in red).

Position port in global supply-chains

To unpack the PLOC metric even more, one can characterise whether the goods that flow through a port are relatively more dependent on domestic or foreign production processes, and relatively more on forward (exporting goods being used in production processes downstream in the supply-chain) or backward linkages (import goods that are produced using production processes upstream in the supply-chain). The relatively importance of these four components determine how ports are positioned differently within the global supply-chain network.

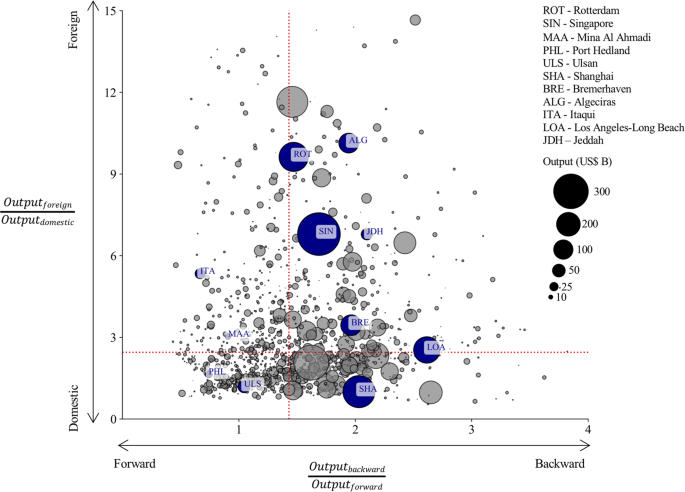

In Fig. 5, we show the relative importance of port throughput in terms its contribution to industry output downstream (forward) or upstream (backward) in the supply-chain and the degree to which output is linked to domestic or foreign supply-chains. We show the position of a number of ports that are all considered macro-critical but located at opposite ends of the spectrum. The ports of Rotterdam, Singapore and Algeciras have large foreign dependencies, with Rotterdam and Singapore being positioned in the middle of supply-chains (mainly due to their role as petrochemicals hub) and Algeciras more towards the end of supply-chains (given its transhipment of manufactured goods). Shanghai and Bremerhaven, on the other hand, have higher domestic dependencies and larger backward linkages. These ports are highly integrated with domestic manufacturing supply-chains (e.g. car manufacturing for Bremerhaven, and electronics and other manufacturing for Shanghai). The port of Los Angeles-Long Beach has large backward linkages, illustrating that it mainly imports goods at the end of the supply-chain, while Ulsan has large forward linkages as it plays a key role in the exports of domestically produced goods (e.g. vehicles). On the left hand side of the spectrum are ports with mainly forward linkages, implying that they mainly export goods that are used in production stages downstream in the supply-chain, such as Itaqui (iron ore and grains) and Mina Al Ahmadi (oil).

The contribution of port-level trade to total output subdivided into forward and backward economic linkages and domestic and foreign economic linkages, capturing the relative importance of the four components. The size of the dot corresponds to the total output linked. The red dotted line depicts the median values across all ports. Ports highlighted in blue and annotated are mentioned in the text.

The PLOC metrics illustrate how domestic and global supply-chains are tied to the port, and how ports are positioned differently in the global supply-chain network. Although beyond the scope of this work, this measure could help evaluate the potential losses within supply-chains networks if ports are disrupted by a shock. Moreover it could help allocate maritime emissions embedded in freight flows going through ports to specific supply-chains.

Port-level import coefficient

As economies grow, and final demand (i.e. domestic consumption and exports) changes in absolute terms and composition, imports through ports are necessary to facilitate this. Due to an increasing fragmentation (i.e. different stages of production in different countries) and globalisation (i.e. global expansion) of supply-chains27,56, the reliance on maritime imports to support final demand has increased. As a complementary metric to describe the feedback between ports and the economy, we use the extended MRIO table to estimate the direct and indirect (through interindustry dependencies) imports per port needed to produce the domestic consumption and exports in the economies they serve. The port-level import coefficient (PLIC, see Methods) quantifies the marginal change in port-level imports for every 1000 USD change in final demand across all economies.

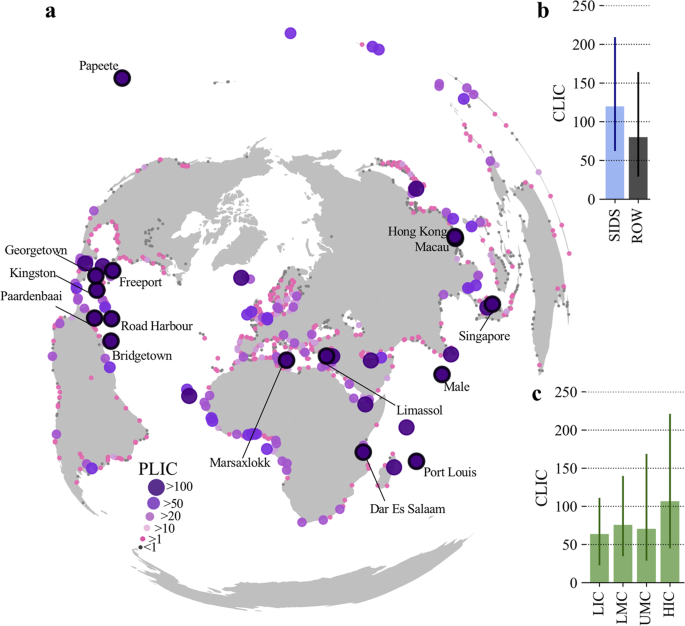

Figure 6a highlights the 15 ports with the largest PLIC values. These top-15 ports all have PLIC values of >170 (up to 486), with 27 ports having a PLIC of >100. The ports with the largest PLIC values are relatively small ports serving island nations (e.g. Maldives, Aruba, Mauritius, French Polynesia), but also the port of Dar Es Salaam serving demand in Tanzania and the landlocked African hinterland. Some larger ports that function as important transhipment hubs (Singapore, Kingston, Marsaxlokk and Freeport) also have large PLIC values, indicating that they are not only essential for connecting ports across the region, but also to meet the final demand in their island economies.

a The global distribution of the port-level import coefficient (PLIC), expressing the USD increase in imports for every 1000 USD increase in final demand. The top 15 ports are highlighted and annotated. b The country-wide maritime import coefficient (CLIC) for Small Island Developing States (SIDS) and to the rest of the world. c Same as (b) but the CLIC of the countries grouped by income level (based on the World Bank income classification). LIC: Low income countries, LMC: Lower middle income countries, UMC: Upper middle income countries, HIC: High income countries.

Similar as with the cross-border throughput dependencies, some ports are more sensitive to demand changes in foreign economies than their domestic economy (Supplementary Fig. 9). For instance, some key ports in Africa (Djibouti, Berbera, Cotonou, Maputo) are more sensitive to changes in foreign demand than domestic demand, as they serve landlocked economies that are larger than their own. Similarly, in Europe, large foreign demand sensitivities are found for the ports of Bar (Montenegro) and Burgas (Bulgaria).

In general, larger PLIC values are found for ports in countries that have a limited number of importing ports and have a high overall trade openness, i.e. they rely disproportionally on foreign products to meet their domestic consumption and for use in domestic production processes that are later exported to other countries. To further explore the differences between countries, we aggregate the PLIC values to the economies they serve (country-level import coefficient, CLIC), indicating the USD increase in country-wide maritime imports due to a 1000 USD increase in final demand.

On a country-level, for every 1000 USD increase in final demand, ports that serve that country experience a median (maximum) 84.6 (501.5) USD increase in maritime imports, underlining large differences between countries. SIDS have a 1.5 times higher CLIC compared to non-SIDS countries (Fig. 6b). Figure 6c displays the CLIC across income groups, showing that low income countries have lower CLIC, as they are often less integrated and diverse supply-chains. In general, manufacturing sectors have larger import coefficients, requiring more maritime imports per unit of final demand56. For instance, across all countries, the Agricultural (sector 1) and Mining and Quarrying (sector 3) sectors require on average 40 USD for every 1000 USD change in sectoral demand, while some manufacturing sectors (sector 9 – 11) require on average 112 – 153 USD for every 1000 USD change in sectoral demand. Therefore, given that high-income countries are generally more diversified (e.g. higher manufacturing base) and better integrated within global supply-chains, they require more maritime import per USD change in final demand.

The import coefficients (on a port and country level) help to understand how future trade flows through ports will change as countries develop (e.g. demand growth), supply-chains restructure (e.g. better supply-chain integration), and sector composition shifts (e.g. higher manufacturing base).

[ad_2]

Source link