[ad_1]

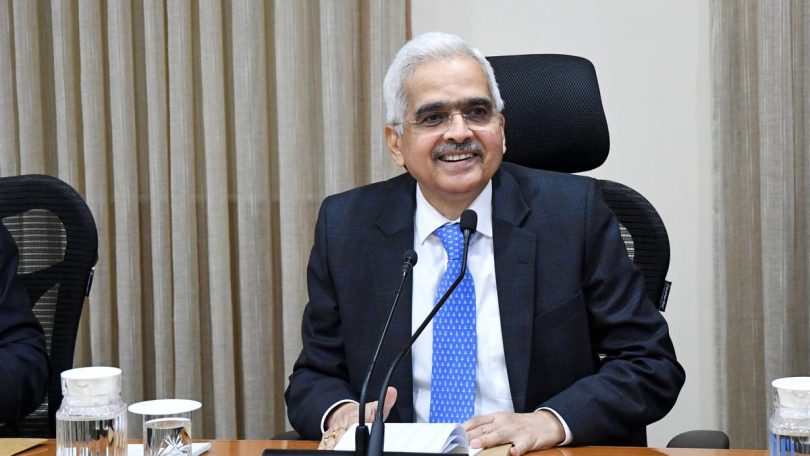

Reserve Bank of India Governor Shaktikanta Das. File

| Photo Credit: EMMANUAL YOGINI

“With India’s current account deficit (CAD) declining sharply to 1% of GDP in Q2:2023-24 from 3.8% in Q2:2022-23,” RBI Governor Shaktikanta Das on February 8 said going ahead, the net balance under services and remittances would remain in large surplus, partly offsetting the trade deficit.

“India’s services exports remained resilient in October-December 2023, driven by software, business and travel services. Moreover, with around 10.2% share in world telecommunications, computer and information services exports, India is a significant player in the world software business,” Mr. Das said in his statement.

He said according to the World Bank, with an estimated $135 billion in inward remittances in 2024, India would remain the largest recipient of remittances globally.

On the financing side, Mr. Das said the net foreign direct investment (FDI) stood at $13.5 billion in April-November 2023 as compared with $19.8 billion a year ago.

“Foreign portfolio investment (FPI) witnessed a sharp turnaround during 2023-24 (up to February 6) with net FPI inflows of $32.4 billion as against net outflows of $6.7 billion a year ago,” he said.

“Net accretions to non-resident deposits and net inflows under external commercial borrowings were also higher during the year,” he added.

“As on February 2, 2024, India’s foreign exchange reserves stood at $622.5 billion .46 Vulnerability indicators suggest greater resilience of India’s external sector. We are confident of comfortably meeting all our external financing requirements,” he further said.

[ad_2]

Source link