[ad_1]

dasilvafa/E+ via Getty Images

Investment Thesis

Ryerson Holding Corporation (NYSE:RYI) is a value-add processor and distributor of industrial materials, which has recently announced the acquisition of Howard Precision Metals. This acquisition can significantly act as a primary catalyst to accelerate the company’s growth with the help of its processing capabilities. Ryerson has also declared a quarterly cash dividend of $0.15 per share, and we can expect this to be sustainable as the company has a healthy cash balance.

About RYI

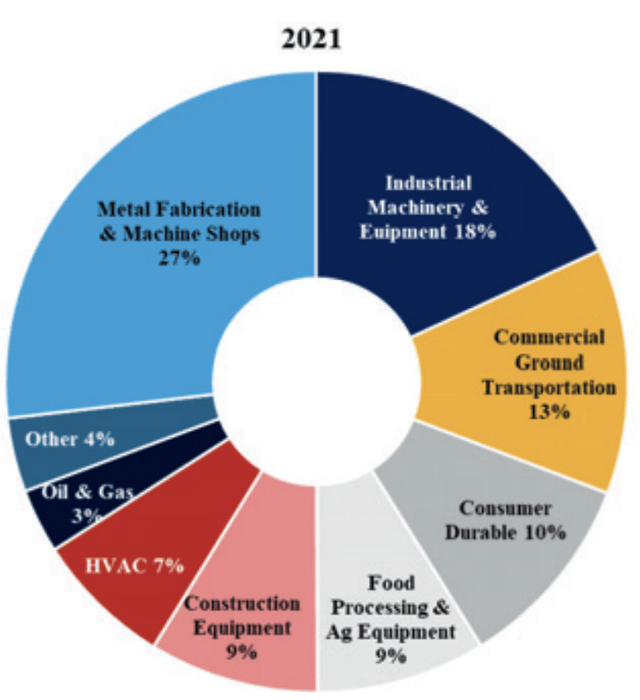

RYI is a value-add processor and seller of industrial metals with a customer base of approximately forty thousand across the manufacturing end-markets. This customer base is spread in various industries, such as metal fabrication, commercial ground transportation, food processing, consumer durables, and construction equipment. The company earns 90% of its revenue from USA customers, and only 10% is earned from foreign customers. It mainly deals in the United States but also has its international facilities in Canada, Mexico, and China, showing the company’s broad global geographic presence. The company generates 27% of its revenue from the metal fabrication industry. The industrial equipment machinery industry contributes 18%, the commercial ground transportation industry contributes 13%, the consumer durables industry contributes 10%, the HVAC industry contributes 7%, the oil & gas industry contributes 3%, and the food processing & construction equipment each industry contributes 9% to the total revenue.

Revenue by End Markets (Annual Report of RYI)

The company also provides a wide range of processing services for most of the products, which require specialized equipment for material handling purposes. The company is gradually diversifying its product mix, which can help them to sell higher-margin services to a larger customer base. This diversification in the product line can reduce the company’s risks associated with dependency on a single product and fluctuations in demand for a particular product. The company has also significantly increased its investment in processing equipment to meet customers’ needs. As processing services are carried out for almost 80% of the products the company sells, this investment can help the company to perform well in terms of profitability.

Acquisition of Howard Precision Metals

RYI has recently announced the acquisition of Howard Precision Metals, which is known as one of the largest aluminum distributors in the Midwest. Howard Precision Metals mainly deals in the distribution of high-quality precision-cut aluminum plates and saw-cut extruded aluminum bars.

RYI was experiencing margin contraction due to geopolitical events such as the Russia-Ukraine war. The sanctions imposed on Russia have resulted in a dramatic increase in metal prices. I believe the acquisition can help RYI to counter the negative impacts of the Russia-Ukraine war, as the processing capabilities of Howard Precision Metals complement Ryerson’s existing business perfectly. The synergized processing capabilities can significantly increase the company’s operational efficiency, resulting in margin expansions. I think the enhanced processing capabilities of the company can make it comparatively stronger than its peers to adapt to market trends with expanded margins.

Dividend Hike and Share Repurchase

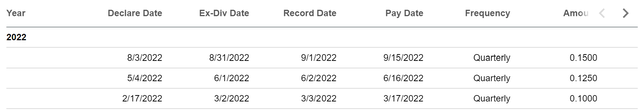

Dividend Table of RYI (Seeking Alpha)

The company’s board of directors has declared a quarterly cash dividend of $0.15 per share, a 20% increase from the second quarter dividend of $0.125. We can see in the above chart that the dividend payment is increasing by $0.25 every quarter. I believe investors can expect the same growth in the current quarter as the acquisition of Howard Precision Metals can lead to higher revenue, profit margins, and the company’s cash balance which can counter the negative effects of the Russia-Ukraine war. I think the total annual dividend payment of the company might be $0.55 per share, which is equivalent to the 2% annualized dividend yield at current price levels.

Along with this, the board has also approved a share repurchase program of $75 million. When we look at the cash and cash equivalents of the company, we can see an increase of 27% compared to the previous year, from $38.1 million to $41.4 million, which can be considered a healthy position for a growing company. I believe this increase can further lead to the sustainability of the company’s dividend payouts in the coming years.

What is the Main Risk Faced by RYI?

The Volatility of Metal Prices

The metal industry is cyclical, and prices and availability of metals are highly volatile due to various factors such as high raw material costs for the production of metals, geopolitical issues, sales levels, and currency rate fluctuations. The metal services industry is largely dependent on domestic and international economic conditions. If the firm is unable to pass these increased costs on to customers, delays between the time of rises in the cost of commodities and increases in the prices that it charges for goods may have a detrimental impact on the company during periods of rising metal prices. If the prices of metals increase, it can increase the company’s cost and affect the demand levels, causing low sales volume and low margins.

Valuation

Ryerson has recorded fair EPS growth in the second quarter compared to last year. This growth was mainly driven by positive momentum in the key end markets. I believe the growth might continue in the coming years as the company has recently announced the acquisition of Howard Precision Metals, which can benefit the company in terms of its processing capabilities. I think this acquisition can lead to margin expansion as the processing capabilities of Howard Precision Metals synergizes perfectly with the existing processing capabilities of RYI.

After considering all the above factors, I am estimating an EPS of $16.25 for FY2022, giving the forward P/E ratio of 1.68x. After comparing the forward P/E ratio of 1.68x with the sector median of 11.31x, we can say that the company is undervalued. Observing the current position of the company and the valuations, I believe the company has a lot of potential to grow, but due to rising raw material prices and geopolitical tension, the share might fail to gain strong momentum and trade below its sector median in coming years. That’s why I estimate the company might trade at a P/E ratio of 3x, giving the target price of $48.75, which is a 78.3% upside compared to the current share price of $27.34.

Technical Analysis

Technical Analysis Chart of RYI (Investing.com)

The stock is trading above its 100-day weighted moving average (WMA) and recently crossed the 50-day WMA. This indicates that the stock has good momentum and can expect an upside from current price levels. As per the RSI indicator, the stock is consolidating in the 50-60 range. This suggests that the stock is in buy territory. The technical indicators are positive for the stock and reflect a buying opportunity.

Conclusion

The company has recently announced the acquisition of Howard Precision Metals, which can significantly boost its performance with its processing capabilities and help it to mitigate the negative impacts of the Russia-Ukraine war. The company has seen a fair EPS growth compared to last year due to its positive momentum in the key end markets, which I believe might continue in the coming years. Considering all the above factors, I assign a buy rating for Ryerson Holding Corporation.

[ad_2]

Source link