[ad_1]

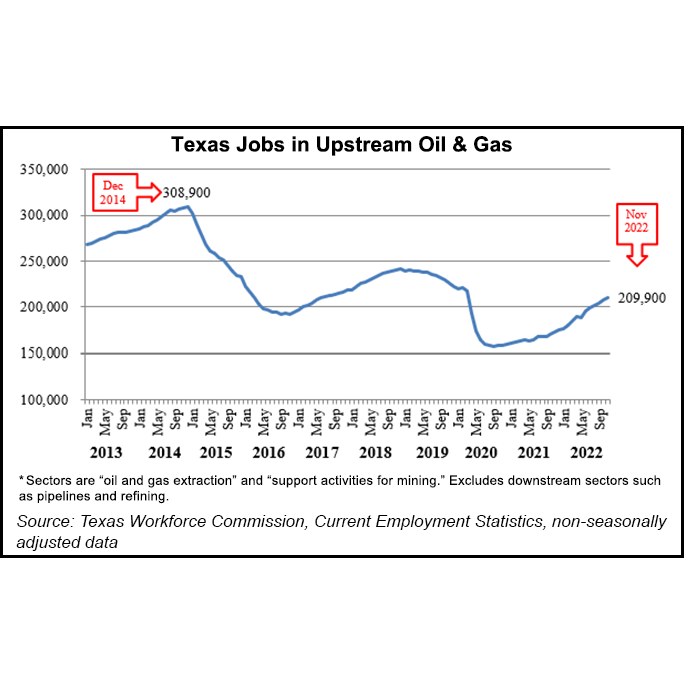

Upstream oil and gas employment in Texas continued to grow in November, with the sector adding 2,600 jobs versus October, data from the Texas Workforce Commission show.

October’s gain also was revised upward to 3,100 from the original estimate of 2,800, said the Texas Oil and Gas Association (TXOGA) in its monthly summary of the data.

“Texas oil and natural gas producers adding jobs while continuing to help to meet our energy needs is a testament to the ingenuity, determination, and resiliency of this industry which fuels our modern way of life,” said TXOGA President Todd Staples. “Texans value the indispensable role that the oil and natural gas industry plays in our state’s economy, our budget and our communities.”

[Want to know how global LNG demand impacts North American fundamentals? To find out, subscribe to LNG Insight.]

The group said upstream employment in the state has shown positive growth in 23 of the 26 months since the pandemic-induced low point of September 2022.

“In that time, industry has added 52,900 Texas upstream jobs, an average growth of 2,035 jobs a month,” TXOGA said. “These jobs pay among the highest wages in Texas, with employers in oil and natural gas paying an average salary of approximately $109,000 in 2021.”

The Texas Independent Producers and Royalty Owners Association (TIPRO), for its part, said the November job total of 209,900 was up by 37,600 positions compared with November 2021. The year/year increase included 7,900 jobs in oil and gas extraction and 29,700 jobs in the services sector.

TIPRO noted that the midstream and downstream segments posted strong job growth in November as well.

“Among the 14 specific industry sectors TIPRO uses to define the Texas oil and natural gas industry, support activities for oil and gas operations continued to dominate the rankings for unique job listings in November with 3,433 postings, followed by crude petroleum extraction (1,523), and petroleum refineries (1,137), indicating a continued emphasis on increasing exploration and production activities in the state,” the group said.

The leading three cities by total unique oil and natural gas job postings were Houston (4,299), Midland (933) and Odessa (524).

“TIPRO’s labor analysis continues to show a high demand for employees in the Texas oil and natural gas industry,” said TIPRO President Ed Longanecker. “Ensuring that we have an adequate pool of available talent to fill current and future positions in our sector will be critical to supporting economic growth in our state and providing energy security to our country and allies abroad.”

John Wood Group plc published the most unique job postings in November with 586 positions, TIPRO said. It was followed by Baker Hughes Co. (541) and KBR Inc. (412).

According to TIPRO, the average annual wage for the Texas oil and gas industry is $132,000, with average wages for the Texas upstream sector exceeding $139,000 annually.

“Top posted industry occupations for November included heavy tractor-trailer truck drivers (497), managers (309) and computer occupations (226),” TIPRO researchers said. “Top qualifications for unique job postings included Commercial Driver’s License (CDL) (403), CDL Class A License (346) and Tanker Endorsement (143).”

Of the unique industry job postings in November, 44% required a bachelor’s degree, 34% a high school or equivalent diploma, and 23% had no education requirement listed, according to TIPRO.

The group also cited data from the Texas comptroller’s office showing that production taxes paid by the oil and gas industry generated $980 million of revenue for the state in November. Producers paid $570 million in production taxes, up 19% year/year, the data showed.

“Natural gas producers, meanwhile, last month also paid $410 million in state taxes, up 41% from November 2021,” TIPRO said. “Funding from oil and natural gas production taxes is used to directly support Texas schools, roads, infrastructure and other essential services.”

The Permian Basin and Eagle Ford Shale are expected to see continued growth in oil and natural gas production in January, according to the Energy Information Administration.

The Permian and Eagle Ford rig counts also posted year/year gains of 20% and 61%, respectively, for the week ended Dec. 22, according to Baker Hughes.

[ad_2]

Source link