[ad_1]

We think that it’s fair to say that the possibility of finding fantastic multi-year winners is what motivates many investors. You won’t get it right every time, but when you do, the returns can be truly splendid. One such superstar is Alok Industries Limited (NSE:ALOKINDS), which saw its share price soar 677% in three years. And in the last week the share price has popped 6.2%. It really delights us to see such great share price performance for investors.

Since the stock has added ₹6.0b to its market cap in the past week alone, let’s see if underlying performance has been driving long-term returns.

However if you’d rather see where the opportunities and risks are within ALOKINDS’ industry, you can check out our analysis on the IN Luxury industry.

Alok Industries wasn’t profitable in the last twelve months, it is unlikely we’ll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last 3 years Alok Industries saw its revenue grow at 36% per year. That’s much better than most loss-making companies. In light of this attractive revenue growth, it seems somewhat appropriate that the share price has been rocketing, boasting a gain of 98% per year, over the same period. Despite the strong run, top performers like Alok Industries have been known to go on winning for decades. So we’d recommend you take a closer look at this one, or even put it on your watchlist.

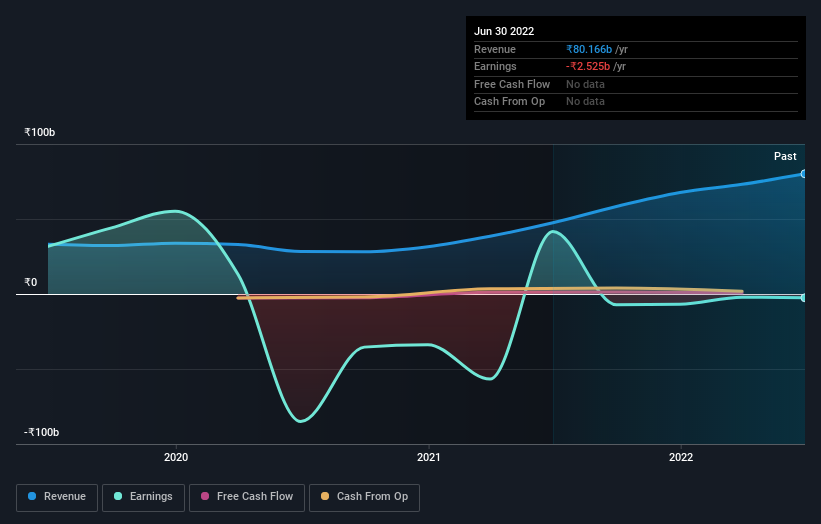

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We’re pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Investors in Alok Industries had a tough year, with a total loss of 15%, against a market gain of about 5.6%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn’t be so upset, since they would have made 49%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we’ve spotted 1 warning sign for Alok Industries you should know about.

Of course Alok Industries may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Discounted cash flow calculation for every stock

Simply Wall St does a detailed discounted cash flow calculation every 6 hours for every stock on the market, so if you want to find the intrinsic value of any company just search here. It’s FREE.

[ad_2]

Source link