[ad_1]

Overall, the energy business, especially upstream operations, has received strong support this year from Russia’s military operations in Ukraine. The price of the commodity surged to multi-year highs early this year amid geopolitical uncertainty since Russia is one of the largest producers of oil.

With high commodity prices, the energy market witnessed ramped-up drilling activities in prolific basins across the globe, reflecting the picture of a handsome business scenario this year. Frontrunners in the industry with exceptional stock price performance so far this year include Precision Drilling Corporation PDS, NexTier Oilfield Solutions Inc. NEX, Nine Energy Service, Inc. NINE, YPF Sociedad Anónima YPF.

High Oil Price

Compared to last year, the oil pricing scenario is significantly better in 2022. Going through the Cushing, OK West Texas Intermediate (WTI) spot price chart of the U.S. Energy Information Administration, it is evident that the average WTI oil prices for every month of 2022 till October were higher than the respective months last year. Like oil, the pricing scenario of natural gas was also healthier this year compared to the previous year.

The Russia-Ukraine war was primarily responsible for the increase in commodity prices, as we have seen the prices cross the $100-per-barrel mark after several years.

Drilling Activities Ramp Up

Higher commodity prices have encouraged explorers and producers to ramp up drilling activities in oil and gas plays. The improvements are reflected in the weekly rig count data published by Baker Hughes Company BKR.

Baker Hughes’ data, issued at the end of every week since 1944, helps energy service providers gauge the overall business environment of the oil and gas industry. The number of active rigs and its comparison with the prior-week figure indicates the demand trajectory for Baker Hughes’ oilfield services from exploration and production companies.

Going through the weekly rig tally figures of BKR, it’s quite clear that from 275 oil rigs as of the week ended Jan 8, 2021, the count skyrocketed to 627 as of the week ended Dec 2, 2022.

Stocks in the Spotlight

Considering the picture of ramped-up drilling following high oil and gas prices, businesses for energy companies have turned sunnier this year. Employing our proprietary Stock Screener, we have zeroed in on energy stocks that have gained more than 100% so far this year. One of the stocks sports a Zacks Rank #1 (Strong Buy), while the other three carry a Zacks Rank #2 (Buy).

Precision Drilling Corporation is a well-known name in the energy space for providing its clients access to an extensive fleet of Super Series drilling rigs. It also offers well service rigs. With high commodity prices, demand for PDS’ drilling rigs was probably favorable, leading the #2 Ranked stock to skyrocket 110.7% year to date.

Image Source: Zacks Investment Research

NexTier Oilfield Solutions is also a well-known U.S. land oilfield service player. With higher exploration and production by upstream companies, demand for NexTier Oilfield’s diverse set of well completion and production services was probably handsome. So far this year, the Zacks #2 Ranked stock gained more than 160%.

Image Source: Zacks Investment Research

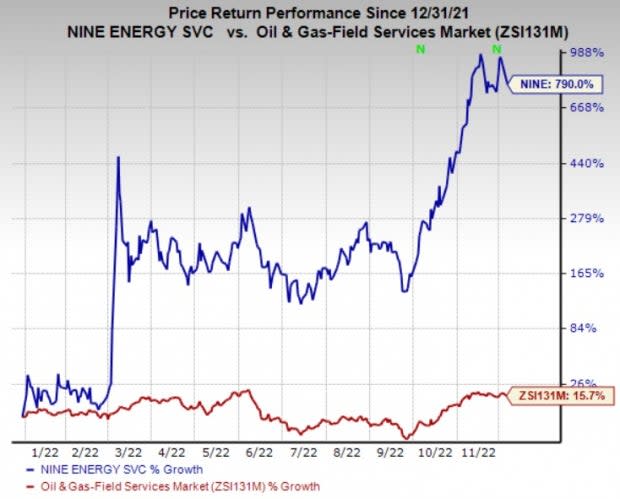

Nine Energy Service, a leading oilfield services company, is also expected to have gained this year from offering higher completion solutions within North America and abroad. With its excellent wellsite execution and superior, cutting-edge technology, Nine Energy has differentiated itself in the energy space. So far this year, the stock with a Zacks Rank of 1 has gained more than 750%.

Image Source: Zacks Investment Research

From higher oil and gas prices, the upstream business of YPF Sociedad Anónima was certainly favorable. So far this year, YPF Sociedad gained more than 100%. For 2022, YPF has witnessed upward earnings estimate revisions over the past 30 days.

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

YPF Sociedad Anonima (YPF) : Free Stock Analysis Report

Precision Drilling Corporation (PDS) : Free Stock Analysis Report

Baker Hughes Company (BKR) : Free Stock Analysis Report

Nine Energy Service, Inc. (NINE) : Free Stock Analysis Report

NexTier Oilfield Solutions Inc. (NEX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

[ad_2]

Source link