[ad_1]

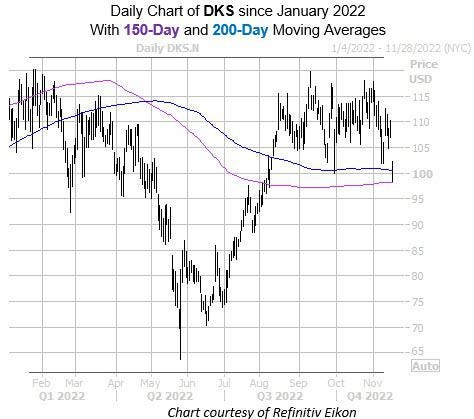

Dick’s Sporting Goods (DKS) stock is breaking below support at the $100-$101 region today, as well as its 200-day moving average, though the 150-day trendline appears to be keeping losses in check. The shares are down 7% at $99.65 at last glance, as the stock succumbs to the retail sector’s slump following Target’s (TGT) current-quarter sales warning.

Refinitiv Eikon

Dick’s Sporting Goods is set to announce its own third-quarter report before the open on Tuesday, Nov. 22. DKS has finished six of its last eight post-earnings sessions higher, including a 9.7% pop this past May. This time around, the options pits are pricing in a next-day swing of 10.4%, regardless of direction, which is greater than the 6.7% move the stock averaged over these last two years.

DKS is seeing plenty of puts exchanged amid today’s slump. So far, 9,401 puts have crossed the tape, which is double the intraday average. The November 98 put is the most popular, with new positions opening there.

This penchant for bearish bets is keeping with the sentiment of the last 10 weeks. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), DKS sports a 50-day put/call volume ratio of 2.28, which ranks higher than 98% of readings from the past year. This shows puts being picked up a much faster-than-usual rate.

It’s also worth noting that short interest makes up an impressive 23.7% of the stock’s available float. It would take nearly eight days to cover these bets, at the equity’s average pace of trading.

[ad_2]

Source link